Technology-Driven Investing: Perks of Applications in Market Exploration

Within the current rapidly changing monetary environment, the integration of digital tools into trading has revolutionized how traders and investors and market participants engage with the financial markets. No longer are the times when navigating the market relied solely on instincts and hands-on computations. Currently, thanks to highly developed trading platforms at their disposal, individuals can harness the power of technology to exercise sound judgement, enhance their tactics, and in the end enhance their trading performance.

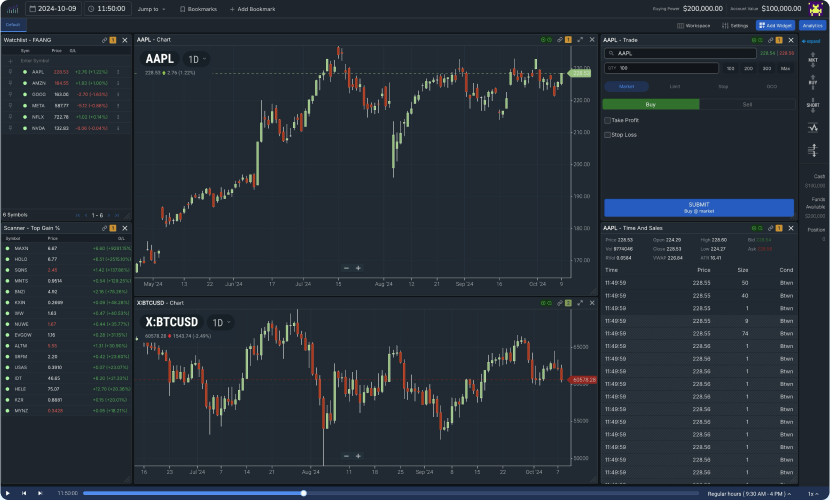

The benefits of utilizing software tools in trading are numerous. Ranging from live analysis of data to robotic trading systems, these tools provide traders with unmatched access to crucial information and sophisticated features. Not only does this reduce the likelihood of errors made by people but it also enables faster responses to market changes. Through incorporating Tradesoft , investors can enhance their standing to seize opportunities and manage threats in a constantly evolving market.

Understanding Trading Systems

A market trading system is a group of rules and approaches that traders use to steer their decisions in the financial markets. These frameworks can range from simple plans based on technical indicators to complex models that utilize ML to analyze vast amounts of information. The main goal of any trading system is to generate steady profits by spotting possibilities in the financial landscape while managing uncertainties effectively.

One of the significant benefits of employing a market strategy is the ability to eliminate emotional bias from decision-making. Investors often struggle with hasty decisions driven by fear or greed, which can lead to significant defeats. By adhering to a clear-cut market strategy, individuals can make more rational and controlled choices, leading to improved overall results. This structured approach allows for a clear evaluation of previous transactions, helping traders refine their approaches over time.

Additionally, modern market strategies often incorporate cutting-edge technology that automate trades and provide real-time data analysis. This technology allows traders to react swiftly to market changes, ensuring they can benefit on emerging trends without delay. The integration of software tools into market strategies has revolutionized the way traders operate, allowing for increased efficiency and enhanced choices in the fast-paced realm of finance.

Key Benefits of Software

A primary benefits of using trading software for trading is the ability to automate processes, which significantly improves efficiency. Automated trading systems can perform trades based on set criteria, removing the need for human intervention. This not only saves time but also ensures that traders can capitalize on opportunities in real-time, even when they are not actively monitoring the markets. This automation helps in minimizing emotional decision-making, which can result in impulsive and potentially damaging trades.

Additionally, a notable benefit of trading software is the access of advanced analysis tools. Traders can leverage various charting and technical analysis features to spot trends and patterns that may not be readily apparent. These tools help in making informed decisions by offering insights derived from comprehensive market data. With powerful backtesting capabilities, traders can also optimize their strategies using historical data, which further enhances their chances of success in the dynamic trading environment.

Finally, software solutions often come with a flexible interface, allowing traders to adapt their experience according to their specific needs and preferences. This adaptability enables users to focus on the metrics and tools most important to their trading strategies. Furthermore, many platforms offer access to a wealth of educational materials and community forums, fostering continuous education and collaboration among traders. This encouraging environment, combined with personalization, empowers traders to navigate the complexities of the market more effectively.

Navigating Trading Obstacles

In the fast-paced world of financial trading, market challenges can emerge unexpectedly, presenting obstacles for traders to navigate. Trading tools have shown to be invaluable in tackling these challenges. By using cutting-edge trading systems, traders can examine vast amounts of data in the moment, allowing them to spot trends and make quick decisions quickly. This ability minimizes the impact of volatility and helps in keeping a strategic|advantage.

Moreover, software solutions often feature automation features that carry out trades at ideal moments. This not only alleviates the emotional stress associated with hands-on trading but also makes certain that chances are captured even when traders are not actively observing the market. Automated trading systems can react to market changes with precision, enhancing the ability to navigate through challenging conditions without delay.

Finally, many trading software programs offer learning resources and analysis tools that help traders improve their skills and knowledge. By providing insights into market behavior and risk control strategies, these systems enable traders to make better decisions. As a result, traders can confidently confront market challenges, making use of technology to improve their performance and attain their financial goals.